How Much Is 1 Bhori Gold in Grams: Full Value Revealed

Gold remains one of the most valuable and trusted assets in India and nearby regions, especially for families who view gold as both emotional wealth and financial security. Even in 2026, gold continues to dominate purchasing decisions during weddings, festivals, inheritance planning, temple offerings, and long-term investment strategies.

While modern jewellers, bullion markets, and banks use grams as the official unit, millions of people still rely on older traditional measurements such as Bhori (Bhari). This cultural measurement unit remains extremely common in many states of India and Bangladesh, where jewellery buying is deeply tied to customs and family tradition.

- Also Read: Live Gold Price Today

Because gold rates are usually displayed online per gram, but local discussions still use Bhori, the most common question buyers ask is:

- How much is 1 Bhori gold in grams, and how do I calculate its exact value for buying, selling, or gold loan purposes in 2026?

This conversion guide explains everything clearly with accurate formulas, updated gold rates, cultural context, and conversion charts for practical decision-making.

What Is Bhori (Bhari)?

Bhori is a traditional unit of gold measurement used extensively in regions such as Maharashtra, Gujarat, Rajasthan, and Bangladesh. Unlike grams, which are internationally standardised, Bhori remains a cultural unit often passed down through generations.

Even today, many local jewellers and families continue to use Bhori, particularly for weddings, temple offerings, and gold inheritance. It’s also commonly referenced when pledging jewellery for a gold loan.

People usually refer to Bhori in daily life like:

- Families planning wedding jewellery prefer using Bhori because it gives a clearer sense of total gold quantity, especially when buying complete ceremonial sets.

- Older generations often describe inherited jewellery in Bhori since it preserves family traditions and avoids confusion caused by decimal-based gram calculations.

- Regional jewellers quote gold prices per Bhori to match local customer habits, making transactions smoother while maintaining trust through familiar measurement practices.

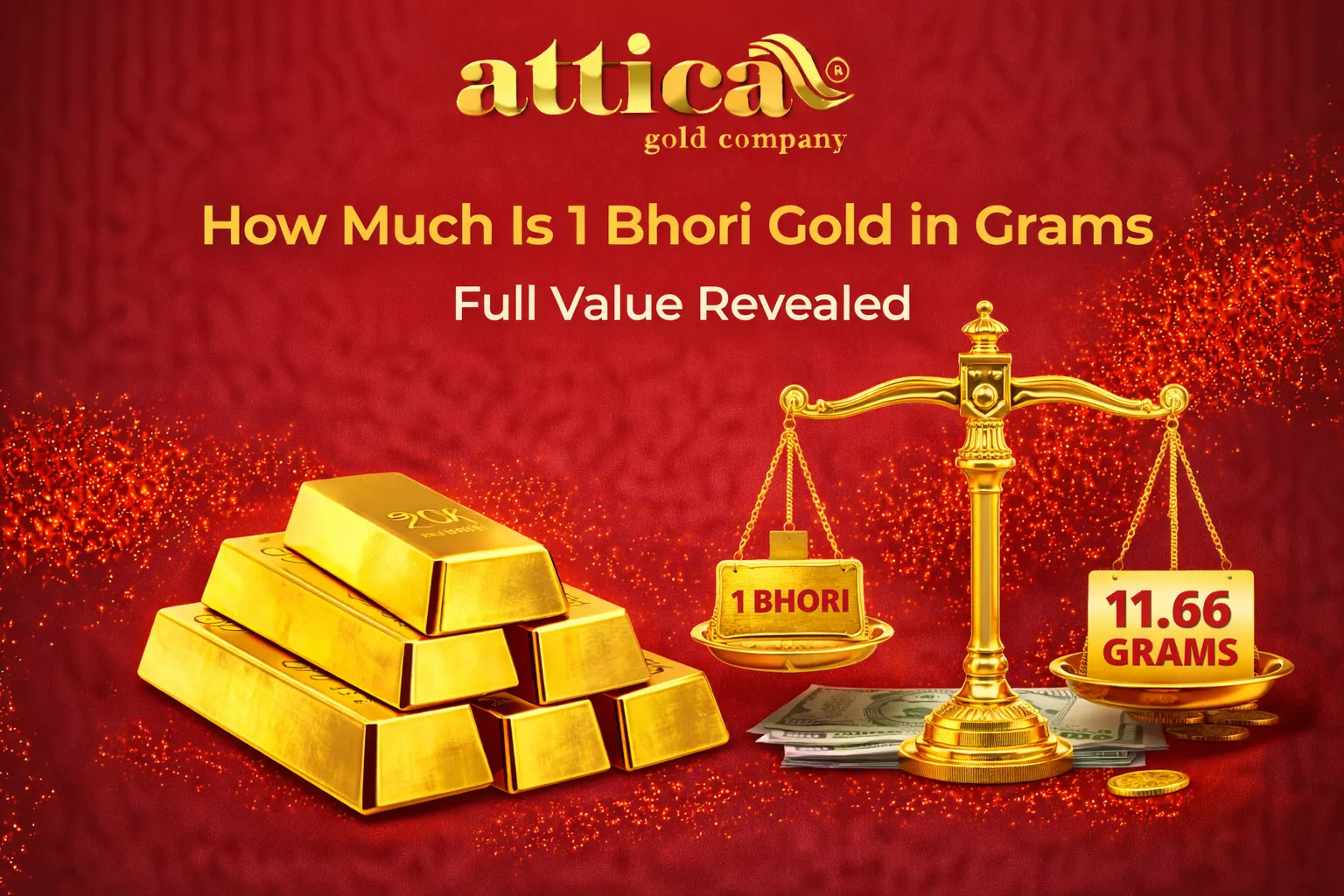

How Much Is 1 Bhori Gold in Grams? (Standard Conversion)

This conversion is widely accepted across jewellery shops, bullion markets, gold loan institutions, and traditional gold traders.

- 1 Bhori Gold = 11.664 grams

This conversion applies to:

- Gold jewellery pieces such as bangles, chains, rings, and necklaces when purchased traditionally using Bhori references rather than gram-based modern billing systems.

- Gold coins and small investment items, especially in regions where families purchase Bhori-weight gold for savings and emergency financial planning purposes.

- Gold bars or investment-grade gold, as Bhori-to-gram conversion helps investors track real market value transparently using updated bullion pricing.

- Inherited ornaments including old family jewellery sets, where Bhori measurements are used for legacy documentation and distribution among heirs.

- Temple donations and religious offerings where families commit specific Bhori quantities for religious ceremonies, blessings, and cultural gifting occasions.

- Gold pledged for loans where borrowers discuss Bhori, but lenders convert it into grams for accurate valuation, eligibility, and repayment calculations.

1 Bhori to Grams Conversion Table

This table is extremely helpful when calculating wedding budgets, comparing jeweller quotations, estimating gold loan value, or understanding the total worth of family gold assets.

| Bhori (Bhari) | Grams |

| 1 Bhori | 11.664 grams |

| 2 Bhori | 23.328 grams |

| 3 Bhori | 34.992 grams |

| 4 Bhori | 46.656 grams |

| 5 Bhori | 58.320 grams |

| 10 Bhori | 116.640 grams |

| 15 Bhori | 174.960 grams |

| 20 Bhori | 233.280 grams |

Why Bhori Is Still Used in 2026

Even in 2026, Bhori continues to remain widely used in many parts of India and Bangladesh due to its cultural trust and practical convenience.

- Deep cultural familiarity across communities: Bhori remains deeply familiar across generations, enabling families to discuss gold holdings easily without converting grams, decimals, or complex calculations during important decisions.

- Preferred for wedding jewellery planning: Wedding jewellery is often planned in Bhori units, helping families estimate required ornaments clearly while maintaining cultural traditions and avoiding confusion with gram measurements.

- Trusted by local and traditional jewellers: Local jewellers continue using Bhori because customers understand it instantly, improving trust, communication, and smoother pricing discussions during jewellery selection and buying.

- Helpful for inheritance division and asset sharing: Bhori simplifies inheritance division by allowing clear distribution of gold jewellery among heirs, preventing disputes caused by fractional gram-based breakdowns.

- Commonly used while pledging gold loans: Many borrowers describe their jewellery weight in Bhori, making conversion knowledge essential because lenders calculate gram-based eligibility, valuation, and loan-to-value ratios.

Bhori vs Bhari – Are They the Same?

Yes. Bhori and Bhari mean the same unit, used interchangeably across different regions and languages.

- 1 Bhori = 1 Bhari = 11.664 grams

The only difference is spelling and pronunciation:

- Bhori is commonly written in gold trade documents, online conversion queries, and modern informational references across jewellery pricing platforms and guides.

- Bhari is commonly spoken in local dialects and family conversations, especially during wedding planning, inheritance discussions, or gold purchase negotiations.

Important notes:

- Bhori indicates weight only, not purity or karat level.

- Purity (24K, 22K, 18K) must be checked separately through hallmarking and jeweller confirmation.

- Final pricing also includes making charges, wastage, GST, and additional fees.

How to Calculate the Value of 1 Bhori Gold Today (2026 Rates)

To calculate the value of 1 Bhori Gold in Grams, you must know these important pricing factors:

- Gold purity (karat)

- Live gold rate per gram

- Making charges (for jewellery)

- Wastage charges (as applicable)

- GST (3%)

- Hallmarking fees

- Stone or setting charges (if jewellery contains gemstones)

Basic Formula (Plain Gold Value Without Extra Charges)

- Bhori Value = Current Gold Rate per Gram × 11.664

Example Calculation (24K Gold Rate: ₹13,500 per gram in 2026)

- 1 Bhori = 11.664 grams

- Value = 13,500 × 11.664

- ₹1,57,464 (Raw Gold Value)

Jewellery Price Example (With Making Charges + GST)

Assume:

- Making charges = 12%

- GST = 3%

Calculation:

- Making charges = 12% of ₹1,57,464 = ₹18,895

- Subtotal = ₹1,57,464 + ₹18,895 = ₹1,76,359

- GST = 3% of ₹1,76,359 = ₹5,291

- Final jewellery cost ≈ ₹1,81,650

This shows why jewellery is always more expensive than the raw gold value, even when the weight remains exactly 1 Bhori.

Today’s 1 Bhori Gold Price by Purity (2026)

Gold purity plays a major role in price because higher karat gold contains more pure gold content. Below is an updated purity-based chart for Bhori valuation.

| Gold Purity | Gold Usage Type | Price per Gram (₹) | Price per Bhori (₹) |

| 24K | Coins, bars, investment gold | ₹13,500 | ₹1,57,464 |

| 23K | Traditional rare ornaments | ₹12,900 | ₹1,50,466 |

| 22K | Wedding & daily jewellery | ₹12,300 | ₹1,43,467 |

| 21K | Antique gold styles | ₹11,700 | ₹1,36,469 |

| 18K | Stone & designer jewellery | ₹10,000 | ₹1,16,640 |

| 14K | Lightweight fashion jewellery | ₹7,800 | ₹90,979 |

Note: These rates exclude making charges, wastage, hallmark charges, gemstone setting charges, and GST.

- You May Also Like: Difference Between Gold Karats: 24K vs 22K vs 18K vs 14K vs 10K Explained

Why Understanding 1 Bhori Gold in Grams Is Essential

Understanding the exact weight conversion protects buyers and sellers from loss, confusion, and manipulation during high-value gold transactions.

- Accurate price comparison across jewellers: Knowing Bhori conversion helps buyers compare multiple jewellers fairly, preventing pricing confusion and ensuring weight-based calculations match gram-based gold rates correctly every time.

- Fair gold loan valuation from banks: Gold loan companies calculate eligibility in grams, so Bhori knowledge ensures borrowers receive accurate value and avoid deductions caused by confusion or incorrect conversion.

- Better resale negotiation outcomes: Sellers who understand Bhori-to-gram conversion negotiate confidently, avoid undervaluation tricks, and secure maximum payout when selling old jewellery or coins.

- Correct investment tracking and planning: Investors can convert Bhori holdings into grams to evaluate portfolio performance using live gold rates and make confident financial decisions with clarity.

- Avoiding purity-related valuation errors: Many people wrongly assume Bhori indicates purity, so understanding weight versus karat prevents costly mistakes involving hallmark checks, pricing accuracy, and jewellery billing transparency.

Difference Between Bhori vs Savaran vs Tola vs Kasu vs Ratti

India’s gold market uses multiple traditional measurement systems, shaped by regional customs, local jeweller practices, and historical trade methods. In 2026, most online gold prices are still shown per gram, but many families continue using traditional units such as Bhori, Savaran, Tola, Kasu, and Ratti during wedding planning, inheritance discussions, temple gifting, and even gold loan pledging.

To avoid confusion and ensure accurate valuation, it is essential to understand how each unit differs in weight, usage, and conversion.

- Bhori: Equal to 11.664 grams, widely used in Bangladesh and several Indian regions for wedding jewellery, gold savings, inheritance division, and traditional household gold budgeting.

- Savaran: Equal to 8 grams, commonly used in South India for bridal jewellery planning, family gold estimation, and traditional jewellery purchases in Tamil Nadu and Kerala.

- Tola or Tulam: Weighs 11.66 grams, widely used in India, Nepal, and the Middle East for bullion transactions, gold coins, and purity-based trade calculations.

- Kasu: A decorative gold coin element used in South Indian jewellery; weight varies between 0.4 and 2.2 grams depending on design, size, and ornament setting style.

- Ratti: A tiny unit equal to 0.12125 grams, traditionally used for gemstone and pearl weighing, rather than full gold jewellery valuation.

Complete Conversion Table (Bhori ↔ Gram ↔ Savaran ↔ Tola ↔ Kasu ↔ Ratti):

| Gold Unit | Weight in Grams (Exact) | Value in Bhori (1 Bhori = 11.664g) | Value per 1 Gram in This Unit |

| Savaran | 8 g | 1 Savaran = 0.686 Bhori | 1 g = 0.0857 Bhori |

| Tola or Tulam | 11.66 g | 1 Tola = 0.999 Bhori | 1 g = 0.0857 Tola |

| Kasu (avg.) | 1 g | 1 Kasu = 0.0857 Bhori | 1 g = 1 Kasu |

| Ratti | 0.12125 g | 1 Ratti = 0.01039 Bhori | 1 g = 8.244 Ratti |

Bhori vs Gram – Which Is Better for Buyers?

When purchasing gold in 2026, the biggest confusion most people face is whether they should calculate gold weight in Bhori or grams. The truth is: both units are correct, but they are used for different purposes depending on your goal—buying jewellery, investing, selling, or taking a loan.

Since online rates and bank valuations are mostly gram-based, understanding the gram equivalent helps you avoid pricing confusion.

Key Conversion Relationship

- 1 Bhori = 11.664 grams

- 1 gram = 0.0857 Bhori (approx.)

Grams are preferred when:

- Buying gold coins or bars for investment: Gram-based pricing makes investment comparisons easier, since bullion platforms and banks use grams universally, ensuring accurate portfolio valuation and standardised pricing everywhere.

- Checking live market gold rates online: Online gold rates are always displayed per gram, so using grams helps you compare city-wise prices quickly and evaluate trends correctly.

- Selling gold to professional buyers: Gold buyers evaluate weight in grams using digital scales, so sellers must understand gram conversion to negotiate confidently and avoid undervaluation.

- Applying for gold loans or financial products: Banks and NBFCs calculate eligibility strictly per gram, making gram-based clarity essential for fair gold loan valuation and approval.

Bhori is preferred when:

- Planning wedding jewellery using tradition: Families plan jewellery in Bhori because it aligns with cultural thinking, simplifies quantity estimation, and matches traditional jewellery patterns commonly purchased for weddings.

- Discussing inheritance and family gold savings: Elder family members often record gold in Bhori, making it easier to track ancestral jewellery holdings without converting into grams.

- Buying traditional jewellery from regional jewellers: Many local jewellers still quote ornaments in Bhori, so understanding Bhori-based weight avoids miscommunication and ensures pricing clarity.

- Estimating larger jewellery sets quickly: Bhori units allow quicker mental calculation for heavy jewellery sets, especially when purchasing multiple bangles, chains, or full bridal sets.

How Bhori Weight Influences Gold Loan Valuation

Gold loans remain one of the most popular borrowing options in India and Bangladesh because they offer fast approval, minimal paperwork, and secured lending backed by jewellery. In 2026, banks and NBFCs continue to value pledged gold purely based on grams and purity, even if you describe it in Bhori.

That’s why understanding 1 Bhori Gold in Grams (11.664 grams) is extremely important for anyone planning a gold loan.

Key Gold Loan Valuation Factors

- Banks evaluate only gram-based weight: Even if customers say Bhori, banks measure jewellery in grams using certified scales, so accurate conversion prevents confusion during loan sanction evaluation.

- Purity directly impacts loan amount: 22K jewellery gets higher valuation than 18K because lenders calculate pure gold content, making hallmark verification essential before pledging ornaments.

- Loan-to-value ratio affects eligibility: Loan approval depends on government-permitted LTV percentage, so accurate gram conversion helps estimate expected loan amount before visiting the lender.

- Non-gold components reduce weight: Stones, beads, enamel, or lac reduce eligible gold weight because lenders subtract them, which can lower total loan value significantly.

- Digital verification avoids disputes: Professional lenders use digital purity and weight tests, so customers with Bhori knowledge can verify fairness and prevent undervaluation disputes.

Wastage, Making Charges, and GST for Bhori Jewellery

Jewellery pricing is never limited to gold weight alone. Even if you understand the exact conversion of 1 Bhari Gold in Grams, your final payable amount depends on multiple components that increase the total cost.

Temple jewellery, bridal ornaments, antique designs, and handmade patterns often carry significant craftsmanship cost. That’s why Bhori jewellery can become expensive even when weight is fixed.

Major Jewellery Pricing Components

- Wastage increases due to complex designs: Jewellery with intricate patterns needs extra gold during manufacturing, so jewellers add wastage percentage that increases the final price beyond raw gold value.

- Making charges vary between shops: Making charges depend on workmanship and design complexity, so comparing multiple jewellers helps buyers avoid paying unusually high labour fees.

- GST adds final tax burden: GST is applied on total jewellery cost including making charges, so buyers must calculate tax impact before confirming the final bill.

- Hallmarking fee ensures authenticity: Hallmarking confirms purity and protects buyers from under-karat gold, so paying hallmark charges improves trust and resale value.

- Stone setting costs raise jewellery price: Jewellery with diamonds or gemstones includes additional setting charges, which increases final cost even though actual gold weight remains unchanged.

Bhori Gold Price Variations Across Indian States (2026)

Gold rates are influenced by international gold markets, currency fluctuations, and domestic demand. However, local market conditions also impact pricing, especially when buying jewellery rather than bullion.

Even though the base gold rate is mostly similar, final jewellery pricing can vary because of:

- Local jewellery demand

- Making charge differences

- Competition between jewellers

- Availability of designs and craftsmanship

Key Differences You Should Know

- Maharashtra market pricing factors: Maharashtra gold pricing depends on Mumbai bullion influence, strong bridal demand, and jeweller competition, causing slight making charge variations across premium showrooms.

- Gujarat gold buying trends: Gujarat has high gold trading culture, and prices often remain competitive, but jewellery wastage charges may increase for traditional heavy designs.

- Rajasthan jewellery cost structure: Rajasthan markets focus on heritage ornaments, so antique designs sometimes include higher making charges due to detailed craftsmanship and traditional artistic finishing.

- Bangladesh Bhori-based trading: In Bangladesh, Bhori remains dominant, and price variations occur due to local currency rate shifts, demand cycles, and jeweller markup structures.

Bhori vs Digital Gold – Which Should Investors Choose in 2026?

Digital gold has grown rapidly because it allows investors to buy gold online without worrying about physical storage, theft, or purity testing. However, physical gold measured in Bhori still remains highly valuable culturally and financially.

In 2026, smart investors usually choose based on purpose:

- If your goal is wedding usage + tradition, physical Bhori gold fits best

- If your goal is pure investment + convenience, digital gold may work better

Bhori Advantages

- Physical ownership with emotional value: Bhori gold offers physical possession, emotional family connection, and cultural satisfaction, making it ideal for weddings, gifting, and traditional wealth preservation practices.

- Resale flexibility in local markets: Physical jewellery can be sold, exchanged, or upgraded easily through local jewellers, giving more flexibility than many digital gold platforms.

- Useful for gold loans instantly: Bhori-based jewellery can be pledged immediately for gold loans, making it a practical emergency asset when quick funds are needed.

Digital Gold Advantages

- No storage or theft risk: Digital gold removes storage worries and theft risk because gold is held in insured vaults, offering peace of mind for modern investors.

- Easy purchase in small amounts: Investors can buy small quantities anytime without needing full jewellery purchases, making digital gold perfect for systematic monthly saving strategies.

- Quick liquidation and selling options: Digital gold can often be sold instantly online at live prices, helping investors access cash without visiting jewellery stores physically.

Practical Tips for Buying Bhori Jewellery

To purchase safely, buyers must understand how much 1 Bhori gold is in grams and follow essential precautions ensuring accuracy, transparency, and quality.

- Check purity and BIS hallmark certification: Always confirm 22K or 24K BIS hallmarking to ensure genuine gold quality and avoid purchasing under-purity Bhori-based jewellery items incorrectly.

- Compare making charges across jewellers: Making charges vary widely, so comparing multiple jewellers helps buyers find fair pricing for Bhori jewellery purchases across different stores.

- Avoid shops using outdated measurements: Some stores inflate weights using unclear units, so always confirm accurate Bhori-to-gram conversion for fair pricing transparency.

- Inspect jewellery weight without stones: Ensure jewellers subtract gemstone weight when calculating Bhori value, preventing inflated final prices for stone-heavy jewellery.

- Check return and exchange policies: Understanding jeweller policies ensures buyers receive fair future resale or exchange value for Bhori jewellery purchased today.

- Use digital gold rate calculators: Calculators help buyers quickly determine the current Bhori value based on the latest per-gram gold rate updates.

These precautions ensure buyers make confident and secure purchases.

Tips for Selling Bhori Gold at the Highest Value

Selling gold requires a strategy. Without proper Bhori-to-gram understanding, many sellers unknowingly accept undervalued offers.

Sellers must know exactly how much 1 Bhori gold is in grams to negotiate effectively and receive maximum value during gold resale transactions.

- Choose buyers offering live market rates: Selling gold at live bullion rates ensures sellers receive the highest possible price for their Bhori jewellery or coins.

- Select trusted BIS-approved gold buyers: BIS-certified buyers use standardized weighing, reducing the risk of undervaluation for customers selling Bhori gold items.

- Avoid pawnshops offering low valuations: Local pawnshops often undervalue gold significantly, offering sellers lower rates than reputable gold-buying companies.

- Weigh gold independently before selling: Using a digital scale ensures sellers confirm accurate weight before negotiations begin, preventing surprise undervaluation tactics.

- Sell during high gold market trends: Tracking gold price trends helps sellers time the market, maximizing the value obtained for Bhori-based gold items.

This ensures sellers avoid losses and achieve the highest gold-selling income.

Common Mistakes Buyers and Sellers Make With Bhori Gold

Many people misunderstand how much is 1 Bhori gold in grams, leading to common mistakes in weighing, pricing, purity checks, and resale evaluations.

- Assuming Bhori indicates purity: Bhori only represents weight, not karat value, leading buyers to incorrectly assume all Bhori jewellery is 22K automatically.

- Ignoring making charges entirely: Buyers sometimes calculate only the gold value, overlooking significant making charges impacting the final purchase price of Bhori jewellery.

- Not comparing jewellers: Many buyers choose the first jeweller they visit, missing better pricing available through comparison across reputable stores.

- Believing coins are pure gold: Many coins are typically 22K; misunderstanding their purity affects valuation accuracy during selling or lending decisions.

- Selling gold without weighing independently: Sellers risk undervaluation when they rely solely on buyer scales without confirming weight through their own measurement first.

Avoiding these mistakes ensures buyers and sellers protect their financial interests.

Conclusion

Understanding “How Much Is 1 Bhori Gold in Grams”, fixed at 11.664 grams, is essential for accurate jewellery pricing, wedding planning, resale valuation, and gold loan calculations in 2026. This conversion removes confusion between traditional and modern units, ensuring buyers make informed and transparent decisions. Whether purchasing ornaments or evaluating family gold, knowing the exact Bhori-to-gram value supports smarter, more confident gold transactions.

Sell Your Gold without Any Hassle

Get the best value for your gold with Attica Gold Company, India’s trusted gold buyer. Attica offers transparent evaluation, live market pricing, and instant payouts. Whether your gold is measured in Bhori, grams, or traditional jewellery units, Attica ensures accurate weight assessment and maximum return. Contact us today to sell your gold at the highest price across India.

FAQs

How much is 1 Bhori gold in grams in India?

1 Bhori gold equals exactly 11.664 grams. This fixed conversion is widely accepted across India and Bangladesh, regardless of jewellery type or seller. Knowing the gram equivalent helps you calculate the accurate Bhori value using daily per-gram rates, compare jeweller quotations, and prevent weight-based misunderstandings. Always confirm the weight on a certified digital scale, because billing, resale, and gold loan valuation are done in grams. This conversion is essential for wedding planning, inheritance calculations, and investment tracking.

Is 1 Bhari gold in grams different from 1 Bhori gold?

No, 1 Bhari gold in grams is not different from 1 Bhori gold. Bhari and Bhori refer to the same traditional weight unit; only the spelling and pronunciation differ regionally. Both equal 11.664 grams. However, people often confuse Bhari with purity, which is incorrect. Bhari indicates weight only, not karat value. Always verify hallmarking for 24K, 22K, or 18K before final pricing. This clarity prevents wrong valuation during buying, selling, exchange, or gold loan pledging.

Why do jewellers use Bhori when billing is done in grams?

Jewellers use Bhori because it remains culturally familiar and helps customers easily estimate jewellery quantity, especially in Maharashtra, Gujarat, Rajasthan, and Bangladesh. Many families still discuss wedding sets and inherited gold using Bhori, making communication faster than using grams with decimals. However, for official billing, tax calculation, and hallmarking records, jewellers must show weight in grams. That is why understanding 1 Bhori gold in grams helps buyers verify whether the billed gram weight correctly matches the quoted Bhori amount during purchase.

How does Bhori conversion help when taking a gold loan?

Bhori conversion is important for gold loans because banks and NBFCs evaluate jewellery strictly in grams and purity. When you know 1 Bhori equals 11.664 grams, you can estimate eligibility before visiting a lender. Lenders may reduce value by deducting stones, beads, or non-gold parts from the net weight. Purity testing also affects valuation, especially for 18K versus 22K jewellery. Accurate Bhori-to-gram knowledge prevents undervaluation, improves negotiation, and helps you choose the best lender offering fair assessment.

What mistakes should I avoid when buying or selling Bhori gold?

The biggest mistake is assuming Bhori indicates purity. Bhori only represents weight, so always check 24K, 22K, or 18K hallmarking separately. Another mistake is calculating value without converting Bhori to grams, which causes incorrect pricing comparisons. Buyers often ignore making charges, wastage, and GST, which increases final cost significantly. Sellers sometimes accept offers without verifying weight on their own scale. To avoid losses, confirm conversion, demand transparent breakup, compare multiple jewellers or buyers, and ensure net gold weight excludes stones or attachments.